Ever paid $50 for a simple generic pill-only to find out the same medicine costs $5 at another pharmacy down the street? You’re not alone. In 2026, cash prices for medications can vary by more than 300% between pharmacies in the same city. That’s not a typo. One prescription for metformin might cost $1.89 at a local independent pharmacy with a GoodRx coupon, and $15.99 at a national chain without one. This isn’t a glitch. It’s how the system works.

Why Cash Prices Vary So Much

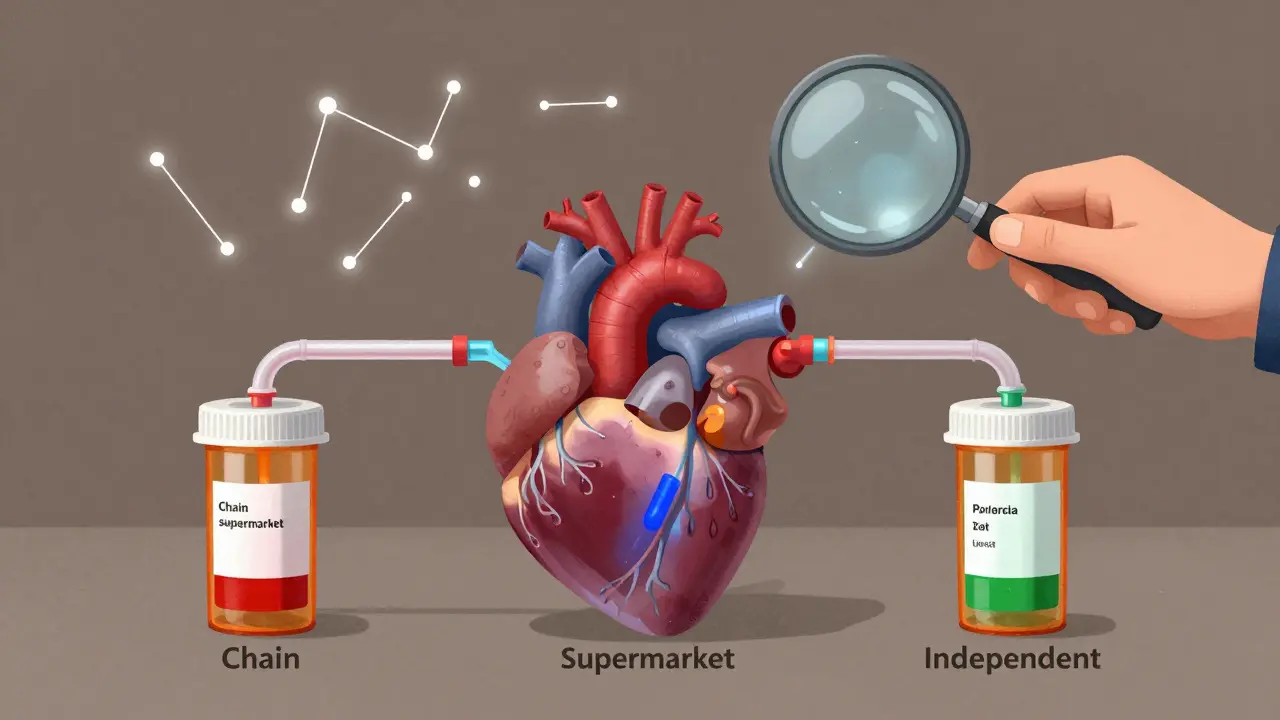

Pharmacies don’t all pay the same for the same drug. Manufacturers set a list price, then offer deep discounts to Pharmacy Benefit Managers (PBMs), insurers, and big retailers-but those savings rarely show up at the register unless you ask. Independent pharmacies, supermarkets, and big chains each have different pricing models. National chains often charge more because they rely on higher margins to cover overhead. Supermarkets and mass merchandisers like Walmart or Costco use prescriptions as loss leaders-they make money on groceries, not pills. And independent pharmacies? They sometimes undercut everyone because they’re trying to keep customers loyal. A 2021 NIH study found that for common generic cardiovascular drugs, the average undiscounted cash price at a national chain was $64.42. At a supermarket pharmacy, it was $28.17-less than half. That gap isn’t random. It’s built into the system. The U.S. Department of Health and Human Services confirms: no one pays more to cover someone else’s discount. Everyone pays what they can negotiate-or what they’re willing to pay.How to Find the Lowest Cash Price

You don’t need insurance to save big. Here’s how to do it:- Ask for the cash price first. Never let them run your insurance without asking. Sometimes, the cash price is cheaper-even if you have coverage. LifeCare Advocates found that 62% of people who asked for the cash price before insurance were shocked by how much they saved.

- Use at least three discount apps. GoodRx is the most popular, but it’s not always the cheapest. Compare with RxSaver, WellRX, and BuzzRx. Each one negotiates with different pharmacy networks. One user in Melbourne found their levothyroxine was $1.99 on GoodRx at Chemist Warehouse, but $0.99 on WellRX at a local independent pharmacy.

- Check local independents. Big chains aren’t always the answer. Smaller pharmacies often have unadvertised discounts for regulars. Ask the pharmacist: “Do you offer any cash discounts?” Many do, especially if you’re picking up refills regularly.

- Look for store-specific programs. Woolworths, Coles, and some independent chains run $4/$9 generic programs. These are usually for 30-day supplies of common meds like atorvastatin, metformin, or lisinopril. Check their websites or ask in-store.

- Consider mail-order for long-term meds. If you take a medication daily, RXOutreach.com offers generics at deeply discounted rates if your household income is under $45,000 a year. You don’t need insurance to qualify.

What Doesn’t Work (And Why)

Not all discounts are created equal. GoodRx and similar tools work best for generics. For brand-name drugs like Humira or Humalog, the savings are minimal-sometimes nothing at all. Why? Because manufacturers don’t offer rebates on brand-name drugs to discount platforms the way they do for generics. If you’re on a brand-name drug, ask your doctor if a generic alternative exists. It’s often just as effective. Also, don’t assume your insurance is helping. Some high-deductible plans make you pay full price until you hit your deductible. In those cases, the cash price with a coupon is almost always cheaper than using insurance. A 2023 survey by Consumer Reports showed that 31% of people with insurance paid more than the cash price because they didn’t check.

Real Savings, Real Stories

People are saving hundreds a year just by shopping around. One Melbourne resident, who takes metformin and lisinopril, switched from a national chain to a local pharmacy using GoodRx. Her monthly cost dropped from $48 to $6. That’s $504 a year saved on two pills. Another user found insulin prices ranged from $98 to $345 for the same vial across four pharmacies within a 2-mile radius. She chose the lowest-and saved $247 per vial. That’s not luck. That’s research. Trustpilot reviews for GoodRx show consistent wins: “Saved $112 on my Synthroid at Walmart.” “Got my blood pressure med for $1.50.” “My husband’s cholesterol pill used to cost $70-now it’s $3.” These aren’t outliers. They’re the norm for people who know how to look.Medicare and Other Programs

If you’re on Medicare, you still need to shop around. Even with Part D, your plan’s preferred pharmacies can cut your costs by 15-25%. During open enrollment (October 15-December 7), compare your plan’s formulary and pharmacy network. Some plans have better deals on certain drugs. Use Medicare’s Plan Finder tool-it’s free and doesn’t require login. The Inflation Reduction Act caps out-of-pocket drug costs at $2,000 a year starting in 2025. That’s huge. But experts warn: if you don’t shop, you’ll still overpay. One pharmacist in Sydney told a patient, “The cap protects you from going broke-but not from paying too much.”

10 Comments

Just tried this with my metformin-went from $42 to $2.50 using GoodRx at a local pharmacy. No insurance needed. I thought I was getting scammed until I checked three apps. Mind blown.

/p>Everyone should do this. It’s not rocket science, just common sense.

Bro in India, we don’t even have this problem. Pharmacies here list prices on the wall. No apps needed. You walk in, ask, pay, leave. The system’s broken in the US because it’s profit-first, people-second. We just need medicine, not a financial audit before a pill.

/p>But hey, at least y’all have apps. We still beg for insulin.

While the premise is empirically sound, the operationalization of consumer-driven pharmaceutical arbitrage is predicated upon a highly fragmented, non-transparent, and structurally inequitable market architecture. The notion that individuals should be expected to perform comparative price analytics across multiple proprietary discount platforms constitutes a form of regulatory failure-a de facto privatization of healthcare literacy.

/p>Moreover, the reliance on third-party coupon aggregators like GoodRx introduces a layer of PBM-mediated rent extraction, wherein the very entities profiting from opaque rebate structures are now masquerading as consumer advocates. The solution is not better apps. It’s price regulation.

Don’t overcomplicate this. If you’re paying more than $10 for a generic, you’re doing it wrong. I’ve saved over $800 a year just by switching pharmacies and asking one question: ‘What’s the cash price?’

/p>It takes five minutes. Do it once. Then do it again next month. Your wallet will thank you. No app is perfect, but using two or three? That’s how you win.

How utterly gauche. One would assume that in a society that prides itself on medical innovation and pharmaceutical advancement, the notion of haggling over $1.89 pills is a grotesque indictment of moral decay. Are we now reduced to bartering for life-sustaining medication like peasants at a medieval fair?

/p>I suppose if one lacks the dignity of comprehensive insurance, one must resort to the vulgar theatrics of coupon-clipping. How quaint. How tragic. How… American.

OMG I JUST REALIZED I’VE BEEN PAYING $67 FOR LISINOPRIL FOR THREE YEARS. THREE YEARS. I WASN’T EVEN USING A COUPON. I THOUGHT THAT WAS JUST WHAT IT COST. I JUST WENT TO WELLRX AND IT’S $1.29 AT THE PHARMACY NEXT DOOR. I’M CRYING. I’M SO STUPID. I’M SO SAD. I’M SO ANGRY. I’M GOING TO TELL EVERYONE. EVERY SINGLE PERSON I KNOW.

/p>YOU NEED TO DO THIS. RIGHT NOW. BEFORE YOU READ ANOTHER WORD. GO. GO. GO.

Interesting how everyone’s acting like this is some groundbreaking hack. It’s not. It’s just how the system’s always worked. The only thing new is that people finally have apps to make it visible. The real story? The fact that we need apps to not get ripped off in the first place.

/p>Just did this with my husband’s cholesterol med. Used GoodRx, RxSaver, and BuzzRx. The local Walmart had it for $3. The chain pharmacy wanted $72. I walked in, smiled at the pharmacist, and said, ‘I’m taking the $3 one.’ She nodded like she’s seen it a hundred times.

/p>It’s not magic. It’s just not letting them run your card before you ask. Do it. You’ll thank yourself later. 🙌

Oh my god, I just realized I’ve been paying $50 a month for Synthroid and I didn’t even know I could get it for $1.50. I’m not just mad-I’m devastated. How many people have I told to ‘just get insurance’? I’ve been part of the problem. I’m so ashamed.

/p>I just posted this on Facebook. I’m telling my mom. My sister. My yoga instructor. My dog. I’m going to print this out and hand it to every pharmacist in my town. I’m going to start a movement. This is wrong. This is so wrong.

Thank you for sharing this. I’ve been telling my elderly neighbors about this for years, but most don’t know how to use apps or feel too embarrassed to ask. I walk them through it-show them GoodRx, help them call the pharmacy. One woman saved $300 last month on her blood pressure med. She cried. Not from sadness-from relief.

/p>It’s not about being savvy. It’s about being kind. Someone should have told us this sooner.