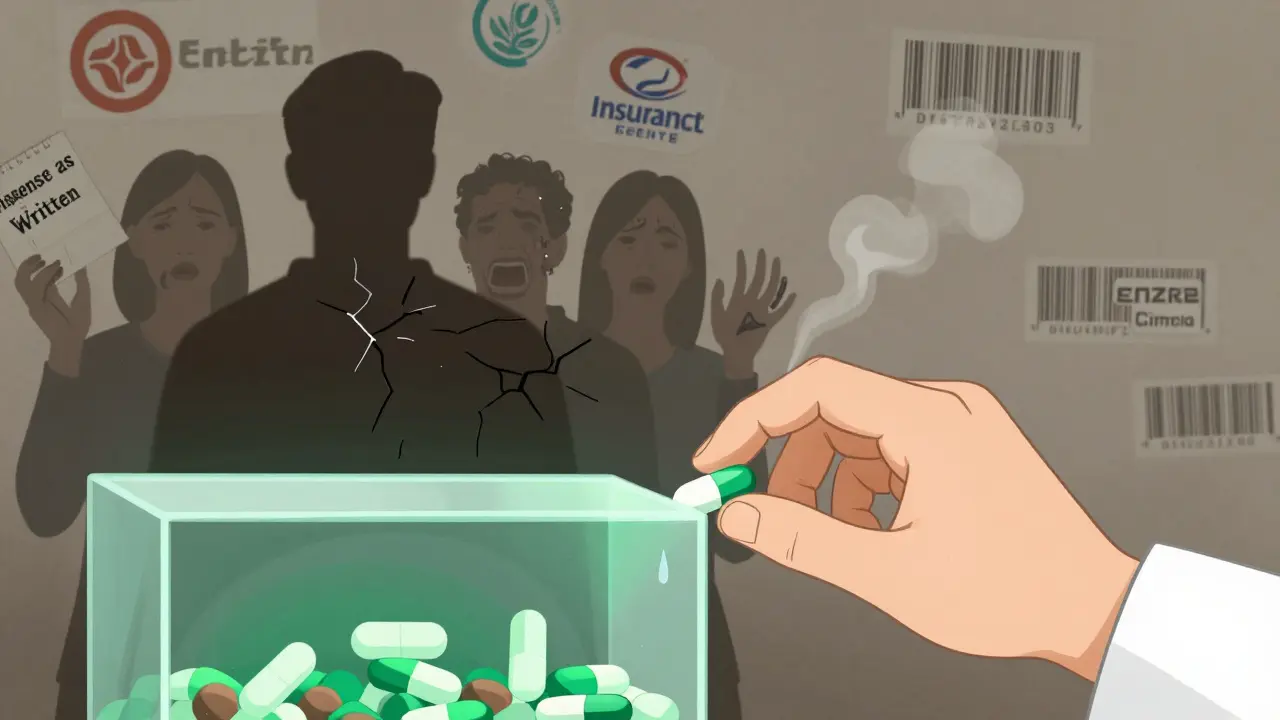

Every time you fill a prescription, there’s a hidden system deciding whether you pay $10 or $1,200 for the same pill. That system is your insurance formulary-a list of drugs your plan will cover, and how much you’ll pay for each. It’s not just a catalog. It’s a rulebook that controls what meds you can get, when you can get them, and whether your doctor’s first choice even matters.

What Exactly Is a Formulary?

A formulary is a list of prescription drugs your health plan agrees to pay for. It’s not random. Every drug on the list has been reviewed by pharmacists, doctors, and cost experts. They look at safety, how well it works, and how much it costs compared to similar options. The goal? Keep care effective while keeping premiums lower. But here’s the catch: not all drugs are treated the same. Most formularies split drugs into tiers. Tier 1 is usually generic meds-cheap, proven, and often just $10-$15 out of pocket. Tier 2 is preferred brand-name drugs-maybe $40-$50. Tier 3? Non-preferred brands. That’s where prices jump to $70-$100. And Tier 4? Specialty drugs. These are for serious conditions like cancer or rheumatoid arthritis. You might pay 33% of the full price-no cap. For a drug like Humira, that could mean $1,200 a month instead of $45.Tiers Are Where You Lose (or Save) Thousands

Moving from Tier 1 to Tier 4 isn’t just a small price hike. It’s a 300-500% increase in what you pay. And it’s not always obvious. A drug might be on Tier 2 with one insurer and Tier 3 with another-even if it’s the exact same medication. A 2022 analysis found that the same prescription could cost $30-$60 more depending on your plan. This is why checking your formulary before you enroll is critical. If you’re on a chronic medication like metformin, insulin, or a biologic, you need to know its tier. Patient Advocate Foundation found that people who verify their meds on their plan’s formulary before signing up save an average of $1,200 a year. That’s not a guess. That’s a real number from real people.What Happens When Your Drug Isn’t on the List?

If your doctor prescribes a drug not on the formulary, you’re stuck. You can pay full retail-sometimes hundreds or thousands-or you can file for an exception. The exception process sounds simple: your doctor writes a letter explaining why you need it. But in practice? It’s messy. CMS data shows 73.2% of exceptions get approved for Medicare Part D. That sounds good. But here’s the problem: it takes 7.2 business days on average. For someone with a life-threatening condition like multiple sclerosis or cancer, waiting over a week can mean a relapse or worsening symptoms. And only 38.5% of expedited requests-those for urgent cases-are approved. Worse, 82% of doctors report delays from prior authorization requests. One in three say those delays caused a serious adverse event in a patient. That’s not a statistic. That’s someone’s life.

Therapeutic Substitution: When the Pharmacist Swaps Your Med

Even if your drug is on the formulary, it might not be the one you get. In 31 states, pharmacists can legally substitute a different drug from the same therapeutic class without asking your doctor. This is called therapeutic substitution. For example: if you’re on Enbrel for rheumatoid arthritis, your pharmacist might give you Cimzia instead-because it’s cheaper and on a lower tier. Both are biologics. Both treat the same condition. But they’re not the same. Side effects, dosing, how fast they work-all can differ. A 2023 study found this happens in 18% of prescriptions. For 5-7% of patients with complex illnesses, it causes real problems: flare-ups, hospital visits, lost work days. You can stop this. Ask your doctor to write “dispense as written” or “no substitution” on your prescription. It’s not guaranteed to work everywhere, but it’s your legal right to request it.Open vs. Closed Formularies: More Choice or More Cost?

There are three main types of formularies:- Closed formularies cover only the drugs on the list. If it’s not there, you pay full price unless you get an exception. About 65% of Medicare Part D plans use this model. They’re cheapest for the insurer-but toughest for you.

- Open formularies cover almost everything. You can get any drug, even if it’s not on the list. But your monthly premium? It’s 12-15% higher. About 22% of Medicare plans use this.

- Partially closed are the middle ground. They exclude certain drugs based on cost or clinical guidelines. Most employer plans fall here.

How to Protect Yourself

You can’t control the formulary. But you can control how you interact with it.- Check your formulary during open enrollment. That’s October 15 to December 7 for Medicare, November 1 to January 15 for ACA plans. Don’t wait until you’re out of pills.

- Use your insurer’s online tool. CMS requires all Part D plans to have real-time formulary lookup. Type in your meds. See the tier. See the copay. Do this every year-even if nothing changed.

- Ask your doctor about alternatives. If your drug is on Tier 4, ask if there’s a Tier 2 version that works just as well. Sometimes there is.

- Request “dispense as written.” If you’ve had bad experiences with substitutions, make it clear on the prescription.

- Know your exception rights. If your drug is denied, your doctor can appeal. Don’t give up after the first no. The approval rate is high-if you push.

What’s Changing in 2025 and Beyond

The rules are shifting fast. Starting January 1, 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 a year. That’s huge. It means even specialty drugs won’t bankrupt you. Insurers are already reworking their tiers to comply. Also, by January 1, 2026, every Part D plan must show you your exact cost at the moment your doctor writes the prescription. No more surprises at the pharmacy. That’s already being tested-and it’s cut prior authorization requests by 28%. Some plans are even testing “value-based” formularies. If your diabetes drug keeps your HbA1c under 7.0%, your copay drops. It’s not widespread yet, but it’s coming. The future is personalized: formularies based on your genetics, your biomarkers, your real-world response to drugs.Real Stories, Real Pain

On Reddit, a user named u/MedicationStruggle posted about Humira moving from Tier 2 to Tier 4. Their monthly cost jumped from $45 to $1,200. They skipped doses. They lost sleep. They cried. A GoodRx survey of 1,500 people found 68% had a formulary-related problem in the past year. 42% skipped doses because they couldn’t afford it. 29% switched to a less effective drug. 18% stopped treatment entirely. These aren’t edge cases. They’re the norm.Final Thought: Your Meds Are Not a Commodity

Formularies exist to control costs. But when they block access to life-saving drugs, they stop being tools-they become barriers. You’re not just a number in an insurer’s spreadsheet. You’re someone who needs to take a pill every day to stay alive. Know your plan. Know your meds. Know your rights. If your insurer won’t give you the drug you need, push back. Document everything. Get your doctor involved. You’re not alone. And you don’t have to accept a $1,200 bill just because a computer decided your drug wasn’t “preferred.”What is an insurance formulary?

An insurance formulary is a list of prescription drugs that a health plan covers. It’s divided into tiers based on cost and clinical value. Only drugs on this list are eligible for coverage, and your out-of-pocket cost depends on which tier your medication is in.

Why does my drug cost more this year even though it’s the same?

Your plan may have changed its formulary. Drugs can move between tiers-sometimes without notice. A drug that was on Tier 2 (low cost) might be moved to Tier 3 or 4 (high cost) to save the insurer money. Always check your formulary during open enrollment.

Can my pharmacist switch my medication without telling me?

In 31 states, pharmacists can substitute a different drug in the same therapeutic class without your doctor’s approval. This is called therapeutic substitution. It’s legal, but it can affect how well your treatment works. Ask your doctor to write “dispense as written” on your prescription to prevent this.

What should I do if my medication isn’t covered?

You can file for a formulary exception. Your doctor must submit documentation explaining why you need that specific drug. Approval rates are high-73.2% for Medicare-but the process takes time. If you’re in urgent need, request an expedited review. Don’t give up after the first denial.

How can I find out what drugs my plan covers?

Every insurer must provide a real-time formulary lookup tool on their website. Log in to your account, search for your medication by name, and check its tier and copay. You can also call member services. Do this every year during open enrollment-even if you didn’t change plans.

Are generic drugs always better than brand-name?

For most people, yes. Generics contain the same active ingredient and work the same way. But for some complex conditions-like epilepsy, mental health disorders, or autoimmune diseases-small differences in inactive ingredients can affect how the drug is absorbed. If a generic isn’t working, tell your doctor. You may need a prior authorization for the brand.

Will the new $2,000 cap on drug costs in 2025 help me?

Yes-if you’re on Medicare Part D and take expensive specialty drugs. The cap means you won’t pay more than $2,000 out of pocket for all your prescriptions in a year, regardless of how many tiers your drugs are on. This is a major change that will protect people with chronic illnesses from financial ruin.

15 Comments

Let me tell you something they don’t want you to know - PBMs are running a Ponzi scheme disguised as healthcare. They take rebates from pharma giants to push expensive drugs onto you, then laugh all the way to the bank while you skip doses. I’ve seen it firsthand - my cousin’s insulin got switched to a ‘preferred’ brand that made her blood sugar spike. They call it ‘cost containment.’ I call it corporate manslaughter. And now they’re pushing this $2,000 cap like it’s a gift? Nah. It’s a bandage on a hemorrhage. The real fix? Ban PBMs. Burn them. Start over.

/p>Look, I get it - formularies are a mess, and yeah, the system is rigged. But here’s the thing: if we just let everyone get whatever drug they want, regardless of cost or clinical equivalence, we’d bankrupt the entire system. I’ve been a pharmacist for 22 years. I’ve seen people cry because they can’t afford Humira. I’ve also seen people get worse because they got a cheaper substitute that didn’t work. The answer isn’t chaos. It’s transparency. Real-time pricing? Brilliant. Mandatory prior auth logs? Yes. But let’s not pretend this is just about greed - it’s about triage in a broken system. We need better tools, not more outrage.

/p>I just wanted to say thank you for writing this. I’ve been on a biologic for lupus for 5 years, and every time my copay jumps, I feel like I’m being punished for being sick. I didn’t know about the ‘dispense as written’ trick - I’m going to ask my doctor tomorrow. I’m not angry anymore. I’m just tired. But reading this made me feel less alone. Thank you.

/p>Oh, so now it’s the government’s fault? No. It’s the pharma CEOs. They’re the ones who jack up prices 500% overnight. Then the PBMs take 30% kickbacks. Then your insurer passes it to you. It’s a three-layer pyramid scheme. And you think the $2,000 cap is enough? That’s less than what I paid for my cat’s cancer meds last year. The real solution? Nationalize drug manufacturing. Or at least let Medicare negotiate like Canada does. But no - we’d rather let billionaires buy yachts while you ration insulin. Pathetic.

/p>Okay, I’m just gonna say this out loud: I used to think formularies were just boring paperwork. Then my mom got diagnosed with MS and we realized her $1,800/month drug was on Tier 4. We cried. We screamed. We called 17 different helplines. Then we found out about patient assistance programs - and holy hell, they exist. I’m not saying the system is fair. But I’m saying: don’t give up. There are people who will fight for you. You just have to ask. And if you’re reading this - you’re already doing better than you think. 💪

/p>Stop whining. If you can’t afford your meds, get a better job. This isn’t Europe. We don’t hand out free drugs here. You want cheaper? Move to India. They’ve got generics for pennies. Or stop being lazy and use GoodRx. Simple.

/p>It’s so sad… I just… I can’t believe we live in a country where someone has to choose between their medication and their rent. I think about this every time I walk past a pharmacy. I think about the person inside who’s crying because they can’t fill their prescription. And then I think - what if it was me? What if it was my child? We’re supposed to be the most advanced nation on earth… and yet we treat medicine like a luxury. I just… I don’t know what to do anymore. 🌿

/p>Quick tip: If you’re on Medicare, use the Plan Finder tool on medicare.gov. Type in your exact meds, zip code, and preferred pharmacy. It shows you real-time costs across all Part D plans. I helped my neighbor switch from Blue Cross to Humana last year - saved her $900/month. It’s not magic. It’s data. Use it. Also, ask for a ‘Tier Exception’ - it’s not a request, it’s a right. They have to respond in 72 hours if you’re in crisis. Don’t take ‘no’ for an answer.

/p>Interesting. So we’re all just pawns in a game designed by people who’ve never had to pay for a pill. But here’s the real question - if formularies are based on ‘clinical value,’ why do the most effective drugs always end up on Tier 4? Coincidence? Or is ‘clinical value’ just a euphemism for ‘what the PBM gets the biggest rebate on’? I mean… think about it. The system doesn’t care if you live or die. It cares if your drug generates a 20% kickback. That’s not healthcare. That’s casino capitalism dressed in a lab coat.

/p>Oh, so now you’re telling me the system is broken? Newsflash: it was never meant to work for you. You think this is about health? No. It’s about profit. And you? You’re the fuel. The more you suffer, the more they profit. Your tears pay for their vacations. Your silence pays for their bonuses. So go ahead - keep checking your formulary. Keep begging your doctor. Keep hoping. But don’t pretend you’re not being exploited. You are. And you always will be.

/p>They’re putting tracking chips in the pills. That’s why they don’t want you to switch drugs. They’re monitoring your body data. I read it on a forum. The same people who run the formularies work for the CIA. Don’t be fooled.

/p>Therapeutic substitution is not ‘dangerous’ - it’s pharmacoeconomic optimization. Biologics are not interchangeable in a clinical sense, but from a population health perspective, cost-effectiveness thresholds justify substitution. The 5-7% adverse event rate you cite is within the margin of expected variance in real-world evidence cohorts. The real issue is lack of provider education on biosimilar equivalence protocols. Fix that, and you reduce litigation risk and improve adherence.

/p>Why do Americans think they deserve free medicine? We don’t get free cars. We don’t get free iPhones. Why should pills be different? If you can’t afford it, don’t take it. Simple. This country is collapsing because people think they’re owed something. Get a job. Work harder. Stop blaming corporations for your laziness.

/p>Okay, but have you ever considered that maybe… just maybe… your body is just not meant to be medicated? Like, what if the real problem isn’t the formulary - it’s that we’ve turned medicine into a crutch? I mean, think about it. We’ve got people on 12 different drugs just to manage the side effects of the other 8. Maybe we need to go back to nature. Fasting. Meditation. Sunlight. I tried stopping my antidepressants for 30 days. I didn’t die. I felt… alive. Maybe the system isn’t broken. Maybe we are.

/p>STOP. LISTEN. I was one of those people who skipped doses because I couldn’t afford it. I ended up in the ER. I lost my job. I lost my apartment. But I didn’t give up. I found a nonprofit that helped me get my meds for $5 a month. I started a support group. Now I help 37 people a week navigate this mess. You think this is hopeless? No. It’s a call to action. You want change? Don’t wait for Congress. Start with your pharmacy. Talk to your doctor. Post on Reddit. Share this. We’re not victims. We’re warriors. And we’re just getting started.

/p>