When you pick up a prescription and see a generic version on the shelf, you might think it’s just a cheaper copy. But behind that simple switch is a powerful, decades-old system designed to drop drug prices by up to 90%. The key? The first generic approval.

What exactly is a first generic approval?

A first generic approval is when the FDA gives the green light to the very first company to submit a complete application for a generic version of a brand-name drug. This isn’t just being first in line-it’s a legal milestone that unlocks 180 days of exclusive rights to sell that generic drug with no competition. During that window, that one company can capture 70-80% of the market. This system was created by the Hatch-Waxman Act of 1984. Before then, generic drug makers had to run full clinical trials to prove their drugs worked-just like the original brand. That cost millions and made generics rare. The Act changed that. It said: if you can prove your generic drug behaves the same way in the body as the brand, you don’t need to repeat the trials. Just show bioequivalence. That’s it. The FDA requires that the generic’s absorption rate (how much of the drug enters your bloodstream) falls within 80-125% of the brand’s. In real terms, that means the difference between a generic and brand drug is usually less than 3.5%. Studies show that’s about the same variation you’d see between two batches of the same brand-name pill.Why does this matter for your wallet?

The first generic approval is the biggest price drop trigger in the pharmaceutical system. Take Humira, a top-selling biologic for arthritis. When Amgen launched its first generic version in September 2023, it captured 42% of the market in just 90 days. Within six months, the price fell by 85%. Before the first generic hits, you might pay $2,000 a month for a brand-name drug. After the first generic enters, that same prescription can drop to $300. And that’s before other generics join the market. By the time five or six generics are available, prices often fall below $100. Since 1984, generic drugs have saved the U.S. healthcare system more than $1.7 trillion. And the biggest chunk of those savings? First generics. They’re responsible for the steepest price drops because they’re the first to break the brand’s monopoly.How does a company get that 180-day exclusivity?

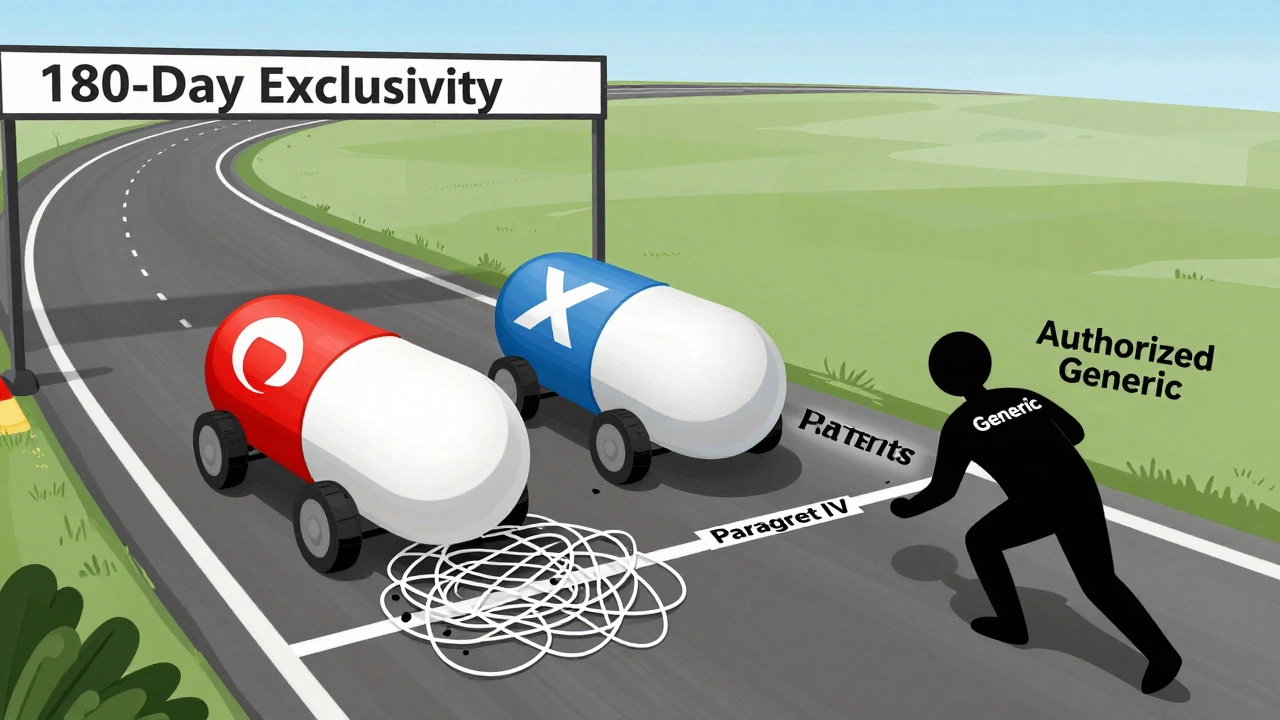

It’s not easy. To qualify, a company must file what’s called an ANDA-Abbreviated New Drug Application. But here’s the catch: to get exclusivity, they must also challenge the brand’s patents with something called a Paragraph IV certification. That’s a legal shot across the bow. It says: “Your patent is invalid or we don’t infringe it.” The brand then has 45 days to sue. If they do, the FDA can’t approve the generic for up to 30 months while the court case plays out. That’s why some first generics take years to launch-sometimes longer than the original patent. If the generic wins in court, or if the brand doesn’t sue, the 180-day clock starts the day the drug hits shelves. That’s when the real money is made. Companies like Teva and Hikma spend tens of millions preparing these applications. Legal fees alone can run $5-15 million per case. But here’s the twist: if two companies file on the same day, they both get the exclusivity. That’s called “multiple first filers.” It happened in 10.6% of cases between 2001 and 2022. And when that happens, the exclusivity gets split. The market share isn’t as big. The price drop isn’t as sharp.

What can go wrong?

Even if you get approved, you can lose your exclusivity. The FDA will strip it if you don’t start selling within 75 days of approval. That’s happened before. Some companies sit on approval, waiting for the brand to drop its price first. The FDA doesn’t allow that. Another problem? Authorized generics. That’s when the brand-name company launches its own unbranded version of the drug-same formula, same factory, just no logo. It’s legal. And it’s common. Between 2015 and 2022, authorized generics entered the market during 38% of first generic exclusivity periods. That can knock 20-30% off the first generic’s sales. And then there’s supply. Pharmacists report that 41% of first generic launches come with shortages or delays. One Reddit thread from 2023 talked about Eliquis (apixaban). The first generic was approved, but manufacturing issues delayed its release by 90 days. During that time, prices stayed high. Patients paid more because the market was stuck.What’s changing now?

The FDA is now pushing harder to approve first generics for complex drugs-things like inhalers, injectables, and topical creams. These are harder to copy because the drug doesn’t just dissolve in your blood-it has to reach a specific spot in your lungs or skin. In 2023, 17 complex generics got first approval, up from just 9 in 2022. The 2022 Inflation Reduction Act also changed the rules. Now, if a drug has a Risk Evaluation and Mitigation Strategy (REMS), the 180-day clock won’t stop just because of paperwork delays. That’s meant to prevent brands from dragging out the process. And the patents? They’re getting thicker. On average, each brand-name drug now has 7.3 patents protecting it. Some are real. Others are just there to block generics. That’s why experts like Dr. Aaron Kesselheim say patent thickets and “pay-for-delay” deals-where brand companies pay generics to wait-are delaying access for 42% of first generics between 2010 and 2020.

What does this mean for patients?

For you, the patient, first generic approval means faster access to affordable medicine. A 2024 survey of 1,200 U.S. pharmacists found that 87% say first generics improve patient access. And 73% say patients stick with their meds longer after switching to a generic. Patient reviews on Drugs.com show first generics rated 4.2 out of 5. The brand-name version? 4.3. People say things like: “Same results, half the cost,” or “No side effect changes.” But it’s not perfect. Sometimes the switch causes confusion. A pharmacist might have to explain why the pill looks different. Or a doctor might need to update the prescription. And if the first generic is delayed, you might pay more for longer than expected.Who wins and who loses?

Patients win. Insurers win. Taxpayers win. The government saves $13 billion a year thanks to generic competition, mostly driven by first approvals. Brand-name companies lose market share fast. But they often plan for it. Many launch their own authorized generics to keep some of the revenue. Others use legal tactics to delay competitors. Generic manufacturers win big-if they win the race. The companies that nail the first approval can make $100-500 million in profit during their 180-day window. That’s why big players like Teva, Hikma, and Mylan invest heavily in patent research, legal teams, and manufacturing capacity.What’s next?

Over $156 billion worth of brand-name drugs will lose patent protection by 2028. That’s a flood of potential first generics coming. The FDA says accelerating these approvals is its top priority. If they succeed, drug prices could keep falling. But the system is fragile. If Congress weakens the Hatch-Waxman Act, or if courts let patent abuse go unchecked, patients will pay more. The first generic approval system isn’t just a regulatory detail-it’s one of the most effective tools we have to control healthcare costs. If your doctor prescribes a brand-name drug that’s due to go generic soon, ask: “Is there a first generic coming?” If yes, you might be able to wait a few months and save hundreds-or even thousands.What is the difference between a first generic approval and a regular generic approval?

A first generic approval goes to the first company that files a complete application and successfully challenges the brand’s patent. It comes with 180 days of market exclusivity, meaning no other generics can sell the same drug during that time. A regular generic approval happens after that exclusivity period ends, when multiple companies can sell the same drug. First generics usually drop prices the most because they’re the first to break the brand’s monopoly.

Why do some first generics take years to launch after approval?

Even after the FDA approves a first generic, the brand-name company can sue for patent infringement. If they do, the FDA must delay the launch for up to 30 months while the court case plays out. Some companies use this delay tactic to extend their monopoly. Others face manufacturing or supply chain issues. That’s why some approved generics sit on shelves for months-or even years-before hitting pharmacies.

Can the brand-name company sell its own generic version?

Yes. That’s called an authorized generic. The brand-name company can make an unbranded version of the drug and sell it through the same distribution channels. It’s the exact same pill, just without the logo. Authorized generics are legal and can enter the market during the first generic’s 180-day exclusivity window. This can cut into the first generic’s profits and slow the price drop for patients.

Are first generics safe and effective?

Yes. The FDA requires first generics to prove they are bioequivalent to the brand-name drug. That means they deliver the same amount of active ingredient into your bloodstream at the same rate. Studies show the average difference in absorption between a first generic and the brand is only 3.5%-less than the variation between two batches of the same brand. Patient reviews confirm they work the same way with no increase in side effects.

How can I find out if a first generic is coming for my medication?

You can check the FDA’s Orange Book, which lists approved drugs and their patent and exclusivity status. Many pharmacy websites also show if a generic version is available or expected. Ask your pharmacist-they often know when a first generic is scheduled to launch. If your drug is expensive and still under patent, it’s likely a candidate for a first generic soon.

What should I do if my first generic is delayed?

If your first generic is approved but not available, ask your pharmacist if there’s an authorized generic you can switch to. If not, ask your doctor if there’s another similar drug on generic that could work. Sometimes, switching to a different generic version-even if it’s not the first-can still save money. Don’t assume you have to wait. There are often alternatives.

15 Comments

It's wild how something so technical-bioequivalence within 80-125%-can literally save lives by making meds affordable. I used to think generics were 'lesser,' but now I get it: it's not about the pill, it's about the system that lets it exist.

/p>Let’s be real-the FDA’s 180-day exclusivity window is basically a gold rush for Big Generic. Teva and Hikma aren’t charities; they’re hedge funds with lab coats. And don’t even get me started on authorized generics. It’s like the brand-name company says, ‘We’ll let you have the market… as long as we take half.’

/p>Patients win. Always.

/p>180 days of monopoly? That’s not innovation. That’s legal arbitrage. And the fact that companies sit on approvals for months? That’s fraud disguised as strategy.

/p>What people don’t realize is that the whole Hatch-Waxman system was designed as a compromise: give pharma a little extra time to profit, but force them to let generics in fast enough to break the price cartel. It worked brilliantly for decades-until patent thickets and pay-for-delay deals started turning the law into a loophole factory. Now we’re seeing 7.3 patents per drug, many of them trivial, just to delay competition. It’s not just about science anymore-it’s about legal warfare.

/p>While the American system is commendable for its regulatory rigor, one must acknowledge that in nations such as India, where pharmaceutical manufacturing is a cornerstone of public health infrastructure, the first generic approval mechanism is not merely a policy-it is a lifeline. The precision with which bioequivalence is measured must be matched by equitable access, lest the fruits of innovation remain confined to those who can afford to wait.

/p>Let me tell you something: every time a generic hits the market, someone’s child gets their asthma inhaler. Someone’s elderly parent doesn’t skip their heart meds. This isn’t about corporate profits-it’s about dignity. And if we weaken Hatch-Waxman, we’re not just hurting the economy-we’re hurting families.

/p>OF COURSE the brand companies launch their own 'authorized generics'-it's like letting the fox guard the henhouse and then acting surprised when the chickens disappear 😒. And don't even get me started on patent trolls pretending their 'new formulation' is revolutionary when it's just a different color pill. #PharmaScam

/p>Wait-so the FDA approves a generic, but then the brand company can just make their own version and undercut it? And we’re supposed to be shocked? This isn’t capitalism. This is feudalism with FDA stickers. Who owns the patent on my blood pressure medicine? The government? No. The shareholders. And they’re laughing all the way to the bank.

/p>Actually, I think the whole system is rigged. What if the 'bioequivalence' standards are just a smokescreen? What if generics don't work the same in long-term use? What if the real problem is that we’ve outsourced drug safety to profit-driven labs? I’ve seen people crash after switching. No one talks about that.

/p>My mom switched to a first generic for her diabetes med last year. Same results. Half the cost. She cried when she saw the receipt. That’s the real win here-not the stats, not the lawsuits. It’s her breathing easier at night.

/p>First generic approval? More like first corporate loophole approval. The 180-day window doesn’t lower prices-it just shifts who profits. And the fact that two companies can split it? That’s not competition. That’s collusion dressed up as policy.

/p>i used to think generics were fake until my dad got his blood thinner switched. he said the pill looked weird but felt the same. now he buys the generic every time. why pay more for a logo? 🤷♀️

/p>The FDA’s approval standards are dangerously lax. There is no long-term data on the cumulative effects of bioequivalent generics across decades of use. This is not science-it’s regulatory gambling with human lives. And you call this progress?

/p>Let’s be clear: if America wants cheap drugs, we need to stop outsourcing to India and China. This isn’t about patents-it’s about national security. The next pandemic won’t care if your blood pressure med is 80% bioequivalent. It’ll care if you can’t get it because the factory’s overseas.

/p>